Dti calculator auto loan

Keltner Colerick A car loan or auto loan is a contract between a borrower and a lender where the lender provides cash to a borrower to purchase a vehicle on the condition that the borrower pays the lender back with the principal and interest over a certain period of time. The bi-weekly payments are set to half of the original monthly payment which is like paying an extra monthly payment each year to pay off the loan faster save on interest.

Debt To Income Ratio Dti Calculator

Rates locked in for duration of loan lower rates than many other forms of financing due to being secured.

. Monthly mortgage or rent payment minimum credit card payments auto student or personal loan payments monthly alimony or child support payments or any other debt. Free interactive calculators to help you prepare you for your next auto loan home loan or plan for retirement and set savings goals. Feel free to use our House Affordability Calculator to evaluate the debt-to-income ratios when determining the maximum home mortgage loan amounts for each qualifying.

There isnt a hard cap on DTI ratio for VA loans. Estimate your monthly car payment with our Auto Loan Calculator for both new and used cars. The price of the car you want to buy the price given to you by the dealership.

To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments credit card minimums and other regular payments. The value of your trade-in if you have one the value of your existing vehicle which youll usually trade in. Lenders will also consider your debt-to-income ratio DTI or how much of your gross monthly income goes toward debt payments.

Enter your loan amount terms and annual interest. Interest rates change regularly so theres a possibility that rates have fallen since you took out your original auto loan. In this case youd add 500 125 100 and 175 for a total of 900 in minimum monthly payments.

Benchmarks can vary by lender and the borrowers specific circumstances. Loan Comparison Calculator. Learn more and use our home.

Divide the 1400 in debts by your 4500 gross monthly income for. Credit cards lines of credit. These payments may include.

Rule of 72 Calculator. Includes full cost breakdowns charts and amortization schedules. Find out the average auto loan rates by credit score how auto loan rates work and where you can get the best auto loan rates.

Target debt with a high bill-to-balance ratio This helps reduce your DTI the most for the least amount of cash paid. To calculate an auto loan you need to determine several factors. Auto loan minimum payment.

5 year auto loan with good credit. Experts also recommend paying off your auto loan before applying for a. To learn what these three.

Consider a variety of factors when determining interest rate including your income credit score and debt-to-income DTI ratio. Interest rates have dropped since you took out your original auto loan. This loan calculator will help you determine your monthly payments for different types of loans.

You are able to accurately measure your financial security by understanding the importance of learning how to use a DTI calculator. Best auto loan rates for those who prefer a bank. Our calculator uses the information you provide about your income and expenses to assess your DTI ratio.

Loan-to-value ratio for mortgage. In addition to your credit score your debt-to-income DTI ratio is an important part of your overall financial healthCalculating your DTI may help you determine how comfortable you are with your current debt and also decide whether applying for credit is the right choice for you. Focus on loan payments Pay off your loans ahead of schedule.

1 day to 1 week. Mortgage Loan Auto Loan Interest Payment Retirement Amortization Investment Currency Inflation Finance Mortgage Payoff Income Tax Compound Interest Salary. If you plan to make a down payment or trade-in subtract that amount from the cars price to determine the loan amount.

When you apply for credit lenders evaluate your DTI to help determine the risk associated with you taking. Normally the front-end DTIback-end DTI limits for conventional financing are 2836 the Federal Housing Administration FHA limits are 3143 and the VA loan limits are 4141. Debts include your 250 payment for an auto loan 850 on your new mortgage and 300 on other debts eg.

The amount you want to borrow to buy the car. Lower DTI or other condition in order to lessen the risk to the lender because a high LTV is seen as a high risk. Even a drop of 2 or 3 percentage points may result in significant savings over the life of your loan.

DTI ratio reflects the relationship between your gross monthly income and major monthly debts. How to Calculate an Auto Loan. Your total debts for the month equal 1400.

Then adjust the gross monthly. Rates locked in for duration of loan. Your down payment a sum of money you pay upfront toward the value of your car.

1 day to 1 week. To determine the house affordability of a VA loan please use our House Affordability Calculator. Compare up to five different loan scenarios side-by-side.

We help people save money on their auto loans with a network of 150. In the Debt-to-Income DTI Ratio drop-down selection there is an option called VA Loan. Bank of America loan details.

How to Calculate Car Loan Payments Article by. For example lets say your gross monthly income is 6500 while your spouses monthly income is. When you submit a business loan application a lender will typically review both your personal and business credit scores to assess the risk you pose.

5 year auto loan with bad credit. Get a Truly Free Credit Score Personalized Advice From Our Credit Experts. Using the above calculator you can determine your DTI ratios before you apply for a mortgage with your spouse.

Use our car loan to value calculator to evaluate your cars LTV ratio and know how a lender may view your cars LTV when you apply for a car loan. Business Personal Credit Scores. This calculator will help you to compare the costs between a loan that is paid off on a bi-weekly payment basis and a loan that is paid off on a monthly basis.

LTV definition and examples March 17 2022 2022 VA Loan Residual Income Guidelines For All 50 States And The District Of Columbia January 2 2020. Alimony and child support payments. While you can still apply for and receive a mortgage loan with a high DTI its best to look for ways to lower the ratio if possible so you can get a better interest rate.

Alternatively extend the duration of your loans to lower your monthly payments. A high DTI may be a sign that you cant take on any more debt without.

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Dti Mortgage Calculator On Sale 57 Off Www Ingeniovirtual Com

What Is The Debt To Income Ratio Learn More Citizens Bank

How To Calculate Your Debt To Income Ratio Lendingtree

Debt To Income Dti Ratio What S Good And How To Calculate It

Debt To Income Ratio What It Is And Why It Matters

What Is A Good Debt To Income Ratio Dti Fit My Money

Dti Calculator Best Sale 50 Off Www Wtashows Com

Understanding Dti And How It Impacts Your Chances Of Getting A Loan Or Credit Card Mid Hudson Valley Federal Credit Union

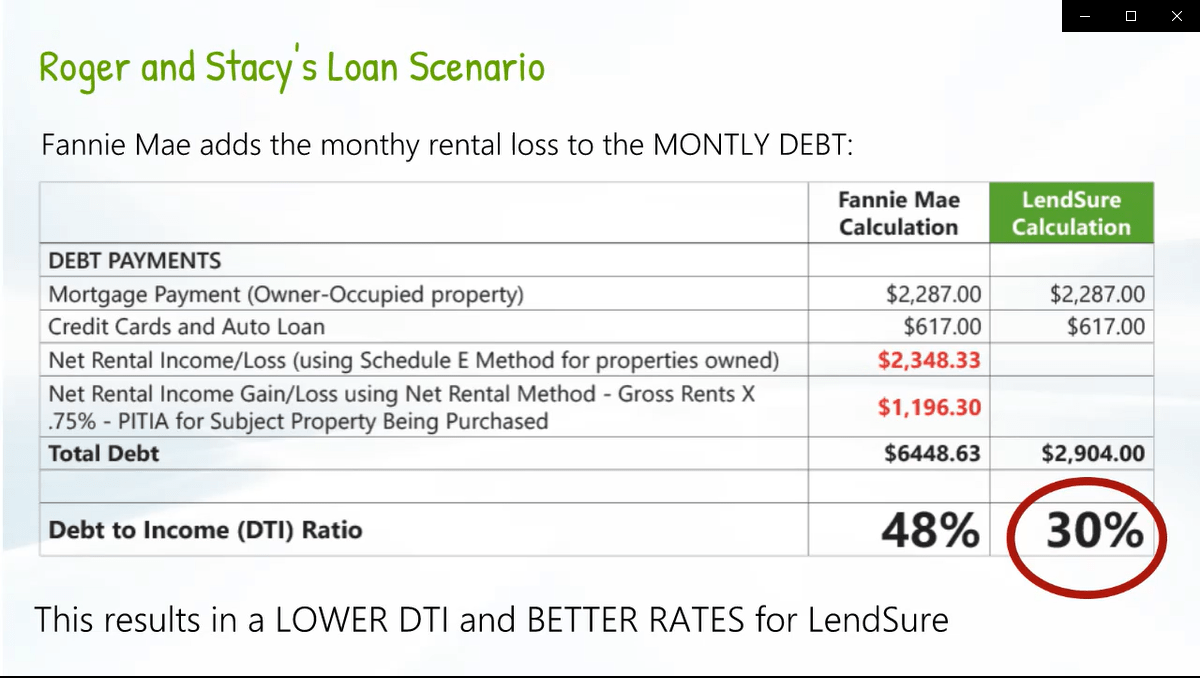

Rental Income Calculation For Better Dti Lendsure Mortgage Corp

Dti Mortgage Calculator On Sale 57 Off Www Ingeniovirtual Com

Debt To Income Ratio Formula Calculator Excel Template

How To Calculate Debt To Income Ratio

Dti Calculator Best Sale 50 Off Www Wtashows Com

Dti Calculator Best Sale 50 Off Www Wtashows Com

Debt To Income Ratio Advance America

Auto Loan Calculator Calculate Car Loan Payments